Chart patterns are visual representations of price movements on financial charts, helping traders identify potential trends and predict future market behavior. Encyclopedia of Chart Patterns by Thomas Bulkowski is a seminal work that systematically analyzes these formations, providing traders with actionable insights and statistical backing to improve their trading strategies.

Overview of Chart Patterns in Trading

Chart patterns are visual tools used to predict market trends by analyzing historical price data. They help traders identify potential buy or sell signals, such as reversals or continuations. The Encyclopedia of Chart Patterns details over 50 patterns, explaining their formation and potential outcomes. This resource is invaluable for traders seeking to enhance their technical analysis skills and make informed decisions.

The Importance of Chart Patterns in Technical Analysis

Chart patterns play a crucial role in technical analysis by offering insights into market sentiment and potential price movements. They enable traders to identify trends, reversals, and continuations, providing a basis for informed decision-making. The Encyclopedia of Chart Patterns highlights their significance, offering statistical data and performance metrics to validate their effectiveness in trading strategies.

Thomas N. Bulkowski and His Contributions

Thomas N. Bulkowski is a renowned expert in technical analysis, best known for authoring the Encyclopedia of Chart Patterns. His work provides a comprehensive analysis of over 50 chart patterns, supported by statistical performance metrics, helping traders make informed decisions.

Biography of Thomas N. Bulkowski

Thomas N. Bulkowski is a prominent figure in technical analysis, celebrated for his meticulous research on chart patterns. With a background in engineering, he transitioned to finance, dedicating years to studying market behavior. His groundbreaking work, Encyclopedia of Chart Patterns, has become an essential resource for traders, offering detailed insights and statistical analyses of various formations. Bulkowski’s contributions have significantly influenced modern trading strategies, making him a trusted authority in the field.

The Creation of the Encyclopedia of Chart Patterns

Thomas N. Bulkowski’s Encyclopedia of Chart Patterns was first published in 2000, followed by a revised second edition in 2005. This seminal work compiles over 50 chart patterns, detailing their formation, statistical performance, and trading implications. Bulkowski’s rigorous research and data-driven approach have made the encyclopedia an indispensable tool for traders seeking to understand market behavior and improve their strategies.

Key Features of the Encyclopedia of Chart Patterns

The encyclopedia provides detailed explanations of chart patterns, supported by statistical performance metrics and practical trading strategies, making it a valuable resource for technical analysts and traders.

Comprehensive Coverage of Chart Patterns

Thomas Bulkowski’s Encyclopedia of Chart Patterns offers an exhaustive analysis of over 50 chart patterns, including bullish, bearish, and neutral formations. Each pattern is thoroughly explained, with detailed statistics on their performance in bull and bear markets. The book also explores event-driven patterns, providing traders with a robust toolkit to interpret and act on market trends effectively.

Statistical Analysis and Performance Metrics

Bulkowski’s work provides rigorous statistical analysis, detailing the success rates and failure rates of various chart patterns. The encyclopedia includes performance metrics such as average price movements and failure rates, enabling traders to make data-driven decisions. This statistical approach ensures that traders can evaluate the reliability and effectiveness of each pattern in different market conditions.

Practical Trading Strategies and Tips

Bulkowski’s encyclopedia offers actionable strategies for traders, including how to identify high-probability patterns and execute trades effectively. It provides tips on stop-loss placement, profit targets, and risk management. The book also highlights which patterns perform best in specific market conditions, helping traders refine their strategies for consistent profitability and minimize losses in volatile markets.

Types of Chart Patterns

Bullish patterns signal upward trends, while bearish patterns indicate downward movements. Neutral patterns, like triangles, show indecision, and event-driven patterns, such as earnings announcements, reflect market reactions to specific news.

Bullish Chart Patterns

Bullish patterns, such as ascending triangles and inverse head-and-shoulders, signal potential upward price movements. These formations indicate buying pressure and strength, often preceding trend reversals or continuations. Bulkowski’s encyclopedia details their statistical performance, helping traders identify high-probability setups and execute profitable strategies with confidence, backed by historical data and market analysis.

Bearish Chart Patterns

Bearish patterns, such as descending triangles and head-and-shoulders tops, indicate potential downward price movements. These formations reflect selling pressure and weakness, often signaling trend reversals or breakdowns. Bulkowski’s encyclopedia provides detailed analysis of their reliability and performance, enabling traders to anticipate and capitalize on market declines with informed decisions, supported by statistical insights and real-world examples.

Neutral and Event-Driven Patterns

Neutral patterns, like rectangles and symmetrical triangles, signal indecision or balance between buyers and sellers. Event-driven patterns, tied to news or earnings, reflect market reactions to specific events. Bulkowski’s encyclopedia categorizes these formations, offering insights into their implications and trading strategies, helping traders navigate uncertain or event-influenced markets with data-backed approaches for optimal decision-making and risk management.

How to Use the Encyclopedia

Traders can use the encyclopedia by identifying patterns, interpreting statistical data, and applying strategies. It serves as a practical guide for making informed trading decisions effectively;

Identifying Chart Patterns

Identifying chart patterns involves recognizing specific shapes like head-and-shoulders, triangles, or wedges. Traders analyze trendlines, support/resistance levels, and volume to confirm formations. The encyclopedia provides clear examples and statistical data to aid in accurate pattern recognition, ensuring traders can identify and interpret formations effectively for informed decision-making.

Interpreting Statistical Data

The Encyclopedia of Chart Patterns relies heavily on statistical data to validate pattern effectiveness. It provides performance metrics, including success rates and market context, enabling traders to assess reliability. By analyzing these statistics, traders can make informed decisions, understanding how patterns behave in different scenarios and improving their overall trading strategies.

Applying Chart Patterns in Trading

The Encyclopedia of Chart Patterns offers practical strategies for integrating patterns into trading plans. It guides traders on identifying formations, setting entry/exit points, and managing risk. By aligning patterns with market conditions, traders can enhance profitability, whether in stocks, commodities, or other assets, ensuring informed and effective decision-making in dynamic markets.

Performance Statistics and Analysis

The Encyclopedia of Chart Patterns provides detailed performance metrics, comparing success rates across bull and bear markets. Statistical insights help traders refine strategies and assess pattern reliability effectively.

Success Rates of Chart Patterns

Thomas Bulkowski’s Encyclopedia of Chart Patterns provides detailed success rates for various formations, comparing performance in bull and bear markets. Statistical analysis reveals which patterns consistently outperform, such as the head-and-shoulders pattern, while others like triangles show varying reliability. Bulkowski’s data-driven approach helps traders identify high-probability setups, enhancing their decision-making process in dynamic markets.

Market Context and Pattern Effectiveness

Market context significantly influences the effectiveness of chart patterns, as highlighted in the Encyclopedia of Chart Patterns. Bulkowski emphasizes that patterns perform differently in bull vs. bear markets, with some formations thriving in specific conditions. Understanding these dynamics is key to improving trading decisions, as context determines reliability and profitability of patterns in varying market environments.

Statistical Significance of Patterns

Bulkowski’s encyclopedia provides comprehensive statistical analysis, rigorously testing chart patterns for reliability and consistency across diverse market conditions; By examining historical performance data, he distinguishes high-probability formations from less reliable ones, offering traders a data-driven approach to predicting market movements and making informed investment decisions with greater accuracy and confidence.

Applications in Modern Trading

Chart patterns remain a cornerstone of modern trading strategies, offering insights into market trends and reversals. The Encyclopedia of Chart Patterns equips traders with actionable knowledge, enabling them to apply tested formations to stocks, commodities, and event-driven scenarios, supported by real-world examples and statistical validation for informed decision-making in dynamic markets.

Using Chart Patterns in Stocks and Commodities

Chart patterns are invaluable in analyzing stocks and commodities, helping traders predict price movements. The Encyclopedia of Chart Patterns details how formations like head-and-shoulders or triangles signal bullish or bearish trends. By applying these patterns, traders can identify potential breakouts, reversals, or continuations, enabling informed decisions. Bulkowski’s work provides statistical backing and practical tips, making it a go-to resource for market analysis and strategy development;

Event Patterns and Market Reactions

Event patterns capture market reactions to specific occurrences like earnings announcements or economic reports. The Encyclopedia of Chart Patterns highlights how these events influence price trends, providing traders with insights to anticipate reactions. Bulkowski’s analysis includes statistical data on the reliability of such patterns, helping traders refine strategies to capitalize on event-driven market movements and improve their decision-making processes in dynamic trading environments.

Case Studies and Real-World Examples

The Encyclopedia of Chart Patterns enriches its theoretical framework with practical case studies and real-world examples. These illustrations demonstrate how chart patterns perform in actual markets, offering traders tangible lessons. By analyzing historical data, Bulkowski provides clear, evidence-based guidance, enabling traders to apply proven strategies and refine their techniques effectively in real-market scenarios, enhancing their overall trading performance and decision-making skills significantly.

The Impact of the Encyclopedia on Technical Analysis

The Encyclopedia of Chart Patterns revolutionized technical analysis by providing a detailed, evidence-based guide to chart patterns, enhancing traders’ ability to make informed decisions and refine strategies.

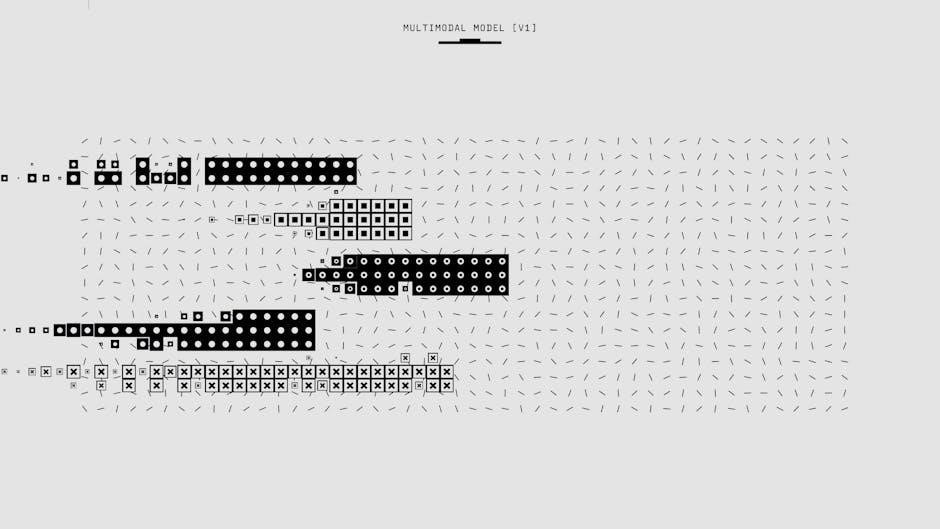

Advancements in Chart Pattern Recognition

Thomas Bulkowski’s Encyclopedia of Chart Patterns introduced groundbreaking advancements by detailing over 75 patterns, including rare and event-driven ones. His work provides statistical validation of pattern reliability, enabling traders to make data-driven decisions. The inclusion of performance metrics and real-world examples has significantly enhanced the understanding and application of chart patterns in modern trading strategies.

Industry Reception and Reviews

The Encyclopedia of Chart Patterns has received widespread acclaim for its comprehensive analysis and statistical rigor. Renowned trader Larry Williams praised it as a “must-read,” highlighting its unique approach to validating patterns. The updated second edition, with new patterns and performance data, solidified its reputation as a go-to reference for technical traders, further enhancing its industry standing and reliability.

The Role of the Encyclopedia in Trader Education

As a cornerstone of trader education, the Encyclopedia of Chart Patterns equips traders with essential knowledge. It bridges theory and practice by explaining pattern behaviors, offering practical tips, and providing statistical evidence. This resource is invaluable for both novices and experts, making it a foundational text in technical analysis and a key tool for improving trading skills and decision-making abilities effectively.

Limitations and Criticisms

The Encyclopedia of Chart Patterns has faced criticism for its reliance on historical data and the subjective nature of pattern interpretation, which may not always align with current market dynamics.

Challenges in Pattern Recognition

Identifying chart patterns accurately can be subjective, as interpretations may vary between traders. Market dynamics and volatility often distort patterns, making recognition challenging. Additionally, the reliability of historical data and evolving market conditions require traders to adapt their strategies continuously to maintain effectiveness.

Criticisms of Statistical Reliability

Some critics argue that the statistical data in chart patterns may not consistently hold across varying market conditions. Sample sizes and data interpretation can lead to discrepancies, questioning the universal reliability of pattern performance metrics. Additionally, evolving market dynamics may render historical statistics less applicable to current trading environments.

Evolution of Chart Patterns in Modern Markets

Chart patterns continue to evolve with advancements in technical analysis and market dynamics. Modern traders incorporate AI and machine learning to identify patterns more accurately. The rise of cryptocurrencies and high-frequency trading has introduced new formations, while traditional patterns adapt to changing market conditions. This evolution underscores the need for traders to stay updated on emerging trends and tools in pattern recognition.

The Encyclopedia of Chart Patterns remains a cornerstone of technical analysis, offering traders a comprehensive guide to identifying and interpreting market trends with proven strategies and insights.

Final Thoughts on Chart Patterns

Chart patterns serve as powerful tools for traders, offering insights into market trends and potential price movements. The Encyclopedia of Chart Patterns by Thomas Bulkowski provides a detailed, evidence-based guide, bridging the gap between theory and practical application. By combining visual examples with statistical analysis, it empowers traders to make informed decisions, ensuring reliability and effectiveness in modern financial markets.

The Future of Chart Pattern Analysis

The future of chart pattern analysis lies in refining recognition techniques and integrating advanced statistical tools. Building on Bulkowski’s foundational work, traders will leverage AI and machine learning to enhance pattern accuracy. The Encyclopedia of Chart Patterns remains a cornerstone, guiding future innovations in technical analysis and adapting to evolving market dynamics for smarter, data-driven trading strategies.